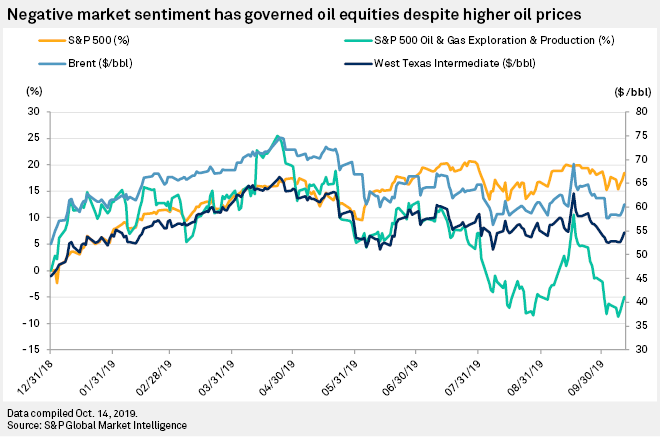

Analysts: Oil market sentiment may be nearing the bottom of the trough | S&P Global Market Intelligence

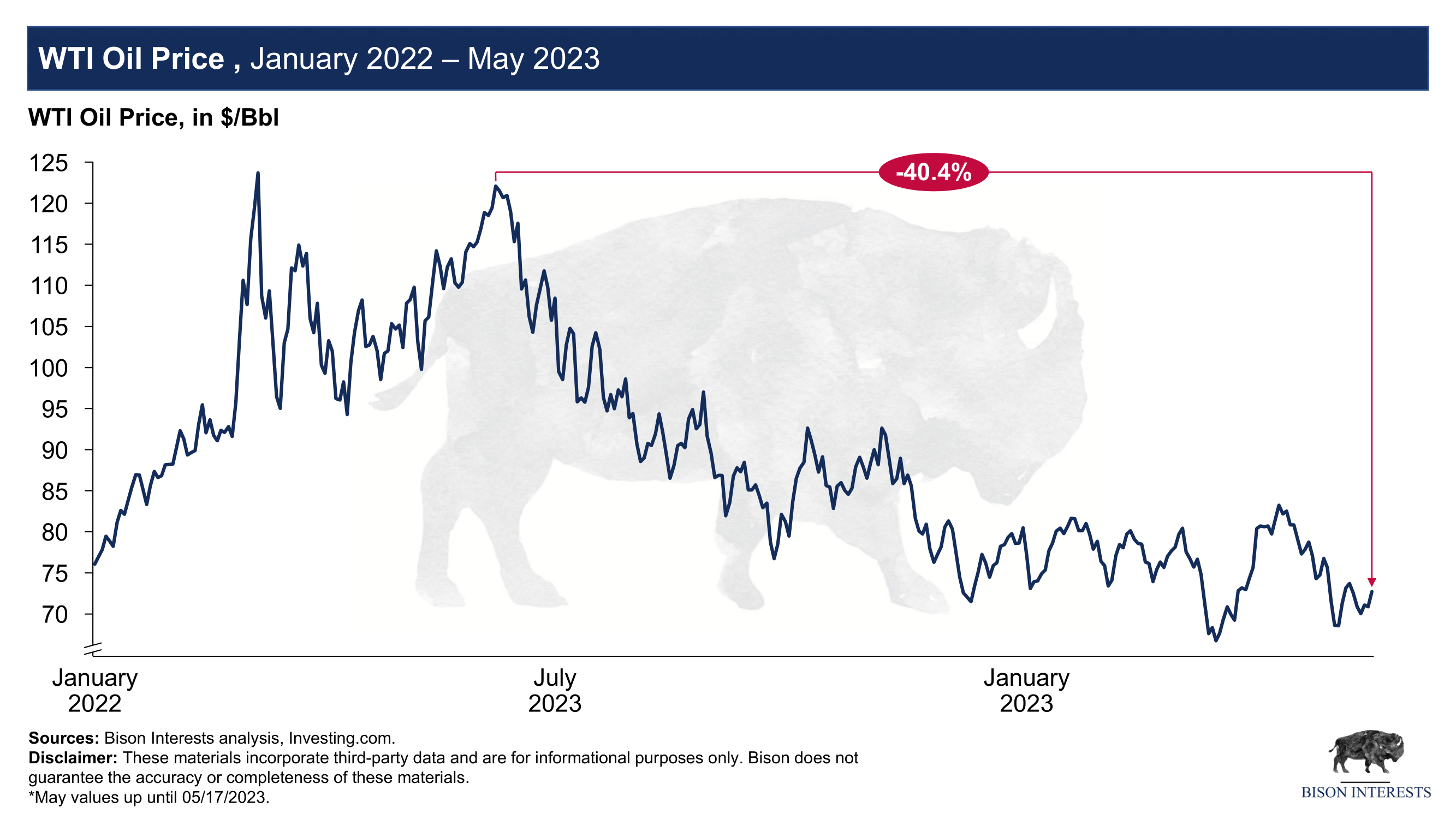

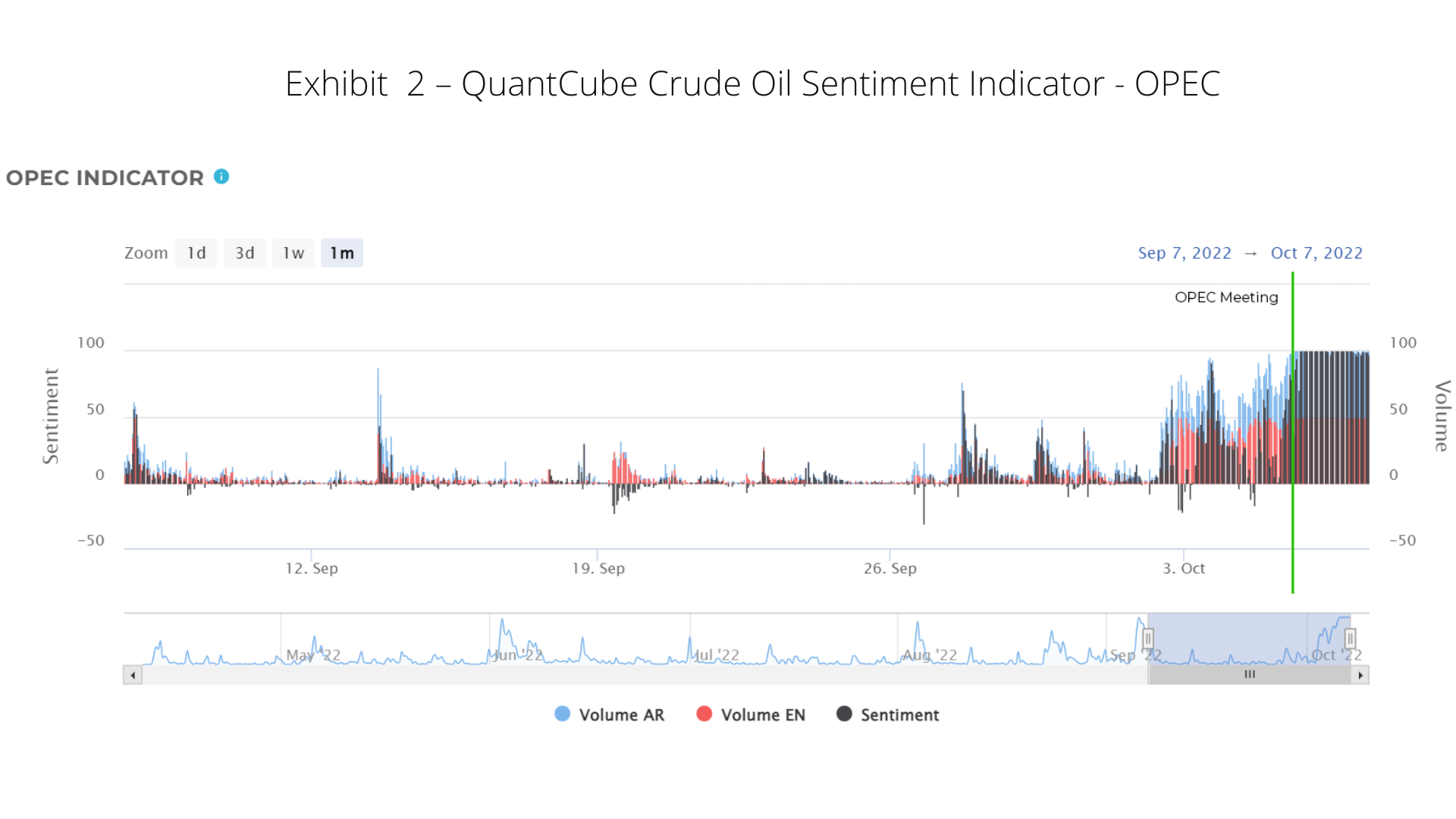

Crude Oil Sentiment – QuantCube's indicator predicts OPEC+ deep oil production cuts — QuantCube Technology

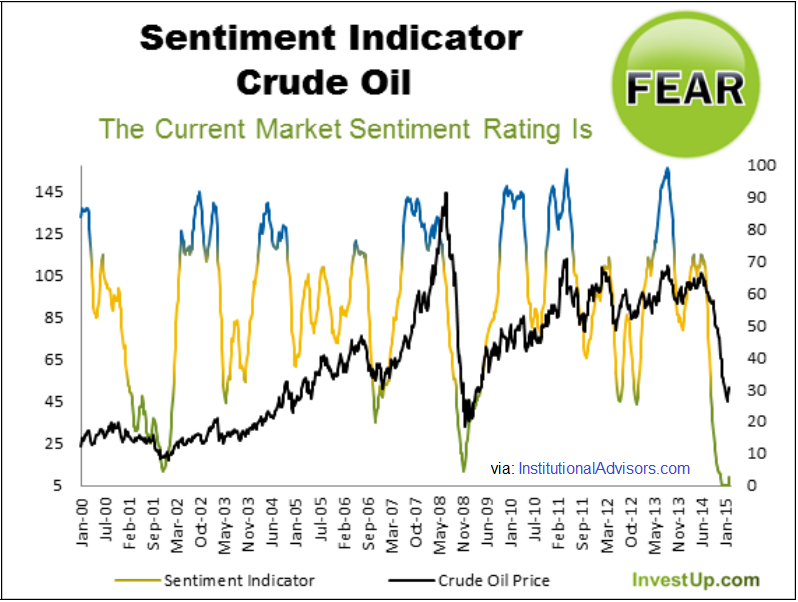

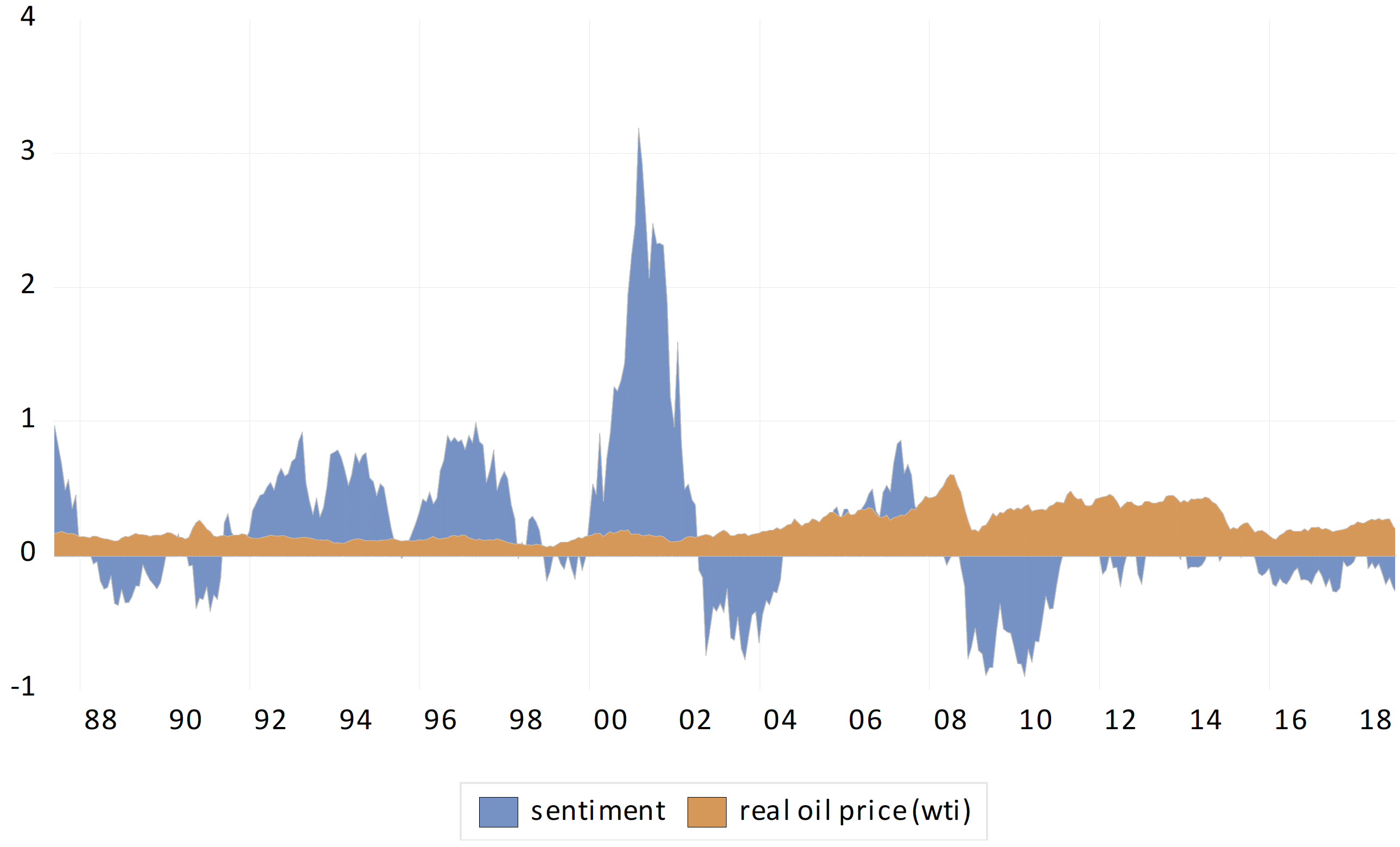

Investor Sentiment and Oil Prices in the United States: Evidence From a Time-Varying Causality Test | Published in Energy RESEARCH LETTERS

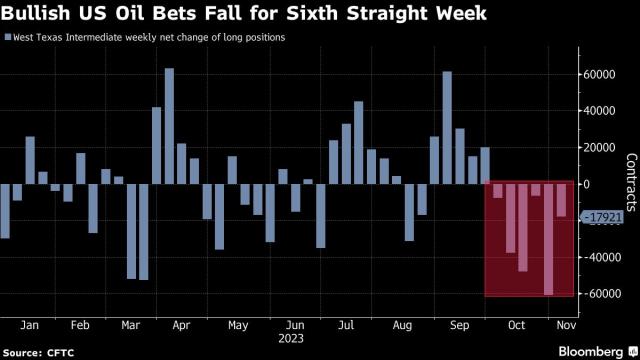

Oil - US Crude IG Client Sentiment: Our data shows traders are now net-short Oil - US Crude for the first time since Nov 05, 2022 when Oil - US Crude traded near 91.88.

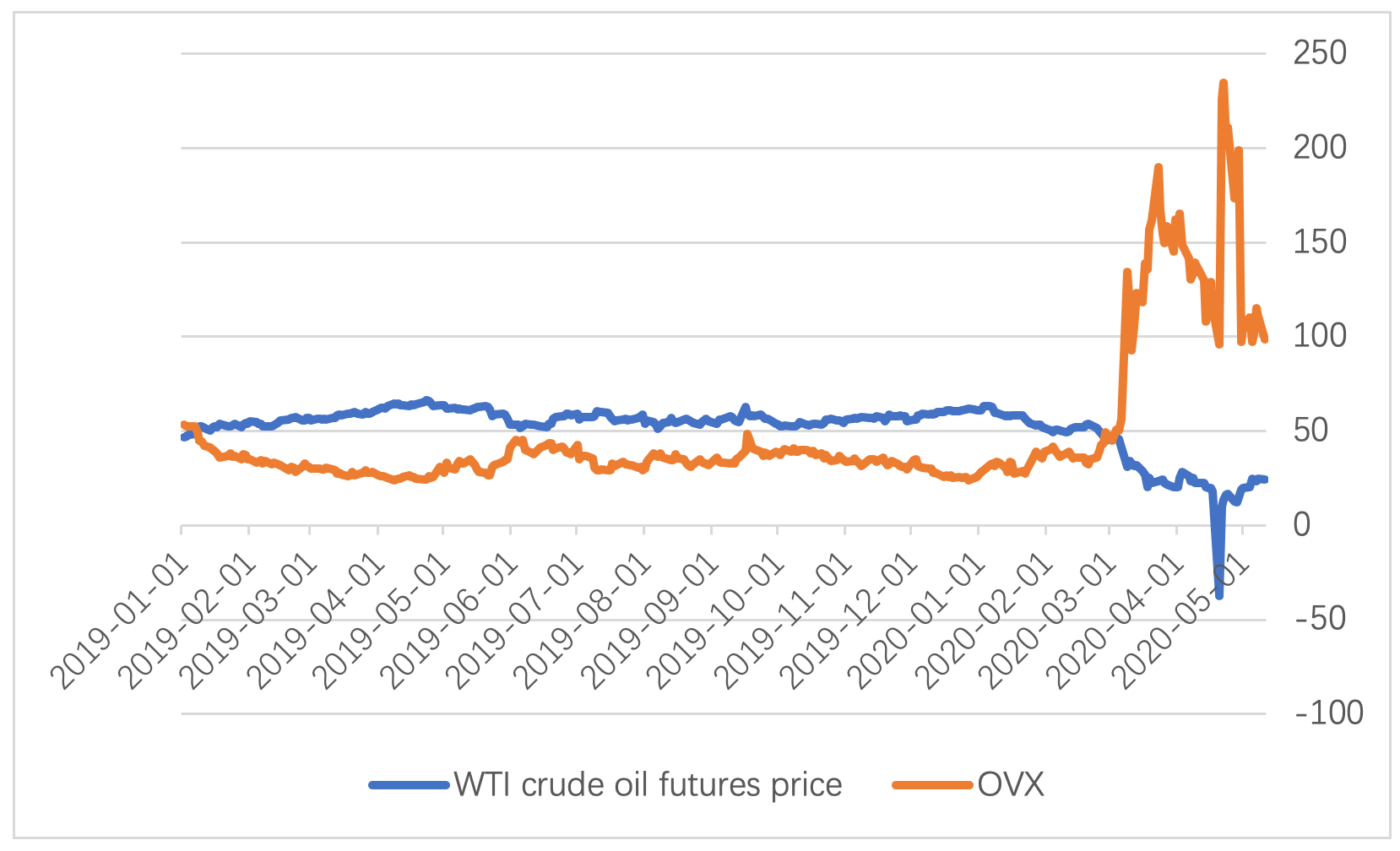

COVID-19: Structural Changes in the Relationship Between Investor Sentiment and Crude Oil Futures Price | Published in Energy RESEARCH LETTERS

Crude Oil Sentiment – QuantCube's indicator predicts OPEC+ deep oil production cuts — QuantCube Technology